Why Figma's IPO Day Matters: A New Era for Design, Startups, and Investors

- Aug 1, 2025

- 7 min read

From democratizing design to disrupting markets — how Figma’s blockbuster NYSE debut reshapes the future of creative collaboration.

If you are a UI designer, there's a high chance that you rely on Figma every single day.

If Google democratized information, Perplexity unleashed knowledge, and GPT unlocked intelligence, then Figma has done the same for design.

Its cloud-native platform empowers anyone — from solo entrepreneurs to Fortune 500 teams — to brainstorm visually, prototype rapidly, and ship polished products with seamless real-time collaboration.

On July 31, 2025, Figma’s IPO priced at $33 per share, valuing the company at $19.3 billion.

Shares closed up nearly 200 percent on day one — one of the largest opening-day pops in tech history.

But Figma’s IPO is more than a financial milestone: it cements design collaboration as a critical pillar of modern product development and signals to founders and investors alike that creative workflows are now core infrastructure.

In this in-depth Figma story, you’ll discover:

The Figma IPO and First-Day Results

Adobe’s Blocked Acquisition & the $1 B Break Fee

Post-IPO Growth & Monetization Strategies

Should You Invest in Figma?

How to Learn Figma Quickly

Launch & Grow Your Business with Figma

1. The Figma IPO and First-Day Results

Why It Mattered The debut of Figma on the New York Stock Exchange under ticker FIG wasn’t simply about raising capital — it represented the ascendancy of cloud-based collaborative design to equal footing with the biggest SaaS enterprises.

Key Metrics

IPO Opening Price: $33/share (above the $30–32 range)

IPO Opening Valuation: $19.3 billion (near Adobe’s aborted offer)

Proceeds Raised: $1.2 billion (mostly via existing-share sales)

First-Day Surge Analysis

Shares skyrocketed to over $125 early in trading, delivering a 198 percent return before settling near $115.

Such a surge underscores:

Investor Demand: A hunger for pure-play SaaS innovators with recurring revenue and high margins.

Product Market Fit: Figma’s traction — serving 95 percent of Fortune 500 — speaks to its indispensability in product development workflows.

Growth Confidence: With $749 million in 2024 revenue and 48 percent year-over-year growth, the market validated Figma’s strategic roadmap.

Ultimately, that IPO day symbolized both a celebration for the design community and a powerful signal to startups that world-class design tooling is no longer reserved for well-funded incumbents.

Adobe’s Blocked Acquisition & the $1 B Break Fee

The Attempted Deal In September 2022, Adobe agreed to acquire Figma for $20 billion, aiming to combine the creative suite leader’s desktop tools with Figma’s real-time collaboration.

Regulators in the EU and UK launched intensive antitrust reviews, concerned that Adobe’s near-monopoly in design software would stifle competition and innovation if it absorbed Figma.

Why It Failed

Antitrust Concerns: Authorities feared reduced choice for designers and higher barriers for startups.

No Acceptable Remedies: Proposed divestitures of code, engineers, and assets could never guarantee a truly independent competitor.

Mutual Termination: After 15 months of scrutiny, Adobe and Figma canceled the merger in December 2023.

The $1 B Break Fee

As stipulated in their agreement, Adobe paid Figma a $1 billion reverse termination fee, delivered in cash within days of the breakup.

This windfall bolstered Figma’s balance sheet — effectively financing further innovation and expansion while preserving its independence and fueling momentum toward a successful IPO.

Post-IPO Growth & Monetization Strategies

Charting the Path Forward With fresh capital and public market scrutiny, Figma must convert its IPO euphoria into sustained revenue growth.

Here are its primary levers:

AI-Driven Innovations

Smart Design Suggestions: Automated color palettes, typography refinements, and layout improvements based on machine learning.

Auto-Prototyping: One-click creation of interactive flows from static wireframes.

Prompt-to-Code (Figma Make): Generate clean React/HTML prototypes directly from natural-language prompts, bridging design to development seamlessly.

Tiered Subscription Model

Free Tier: Unlimited viewers, up to 3 editors — ideal for freelancers and small teams.

Professional Plan: Advanced version history, team libraries, and plugin support for growing startups.

Organization & Enterprise: SSO, audit logs, design system analytics, and dedicated account management to serve large enterprises.

Ecosystem Expansion & Partnerships

Plugin Marketplace: Over 2,000 community-built extensions — from automated charting tools to accessibility checkers — drive stickiness and upsell opportunities.

Adobe Integrations: Shared access to Adobe Fonts and Stock assets, with Creative Cloud library sync slated for late 2025.

Strategic Acquisitions: Dynaboard (no-code dev) demonstrates Figma’s playbook of acquiring talent and tech to fill adjacent needs.

Enterprise Sales & Services

Consulting & Training: Premium support and workshops for large clients.

Custom SLAs: Service-level agreements ensuring uptime and compliance for mission-critical deployments.

About Investment Strategy

Should You Invest in Figma?

Balancing Risk and Reward That spectacular first-day pop inevitably introduces two schools of thought:

Short-Term Caution

Overheated Valuation: Trading at roughly 25× 2025 revenue, Figma commands a premium even among high-growth SaaS peers.

Lock-Up Pressure: When early-investor lock-ups expire in 6–9 months, fresh stock could weigh on share price.

Volatility Ahead: Historical patterns show mega-pop IPOs often face a period of consolidation as hype cools.

Long-Term Opportunity

Category Dominance: Figma holds ~40 percent market share in collaborative design, with robust brand loyalty in tech and enterprise circles.

Adjacent Markets: Expansion into developer tools, no-code web builders, and AI-augmented workflows widens the addressable market.

Strong Fundamentals: $749 million in revenue with 48 percent YoY growth, 90 percent+ gross margins, and $1 billion cash infusion from the Adobe break fee.

Investment Thesis

For long-horizon investors, Figma’s leadership in design collaboration, its relentless velocity of product innovation, and its strategic position at the intersection of design, development, and AI suggest a compelling multi-year growth story — best approached via dollar-cost averaging to weather near-term fluctuations.

About Learning Strategy

How to Learn Figma Quickly

Beginner-Friendly, Scalable Skills Learning Figma unlocks potent creative and career opportunities.

Here’s your roadmap:

Get Setup

Sign up free at figma.com or install the desktop app.

Explore Figma’s official Learn resources and free community events.

Structured Courses

Udemy: “Figma UI/UX Design Essentials” and project-based classes.

Youtube Channels. There are Youtube channels with Figma-focused content. Here or Here

Hands-On Projects

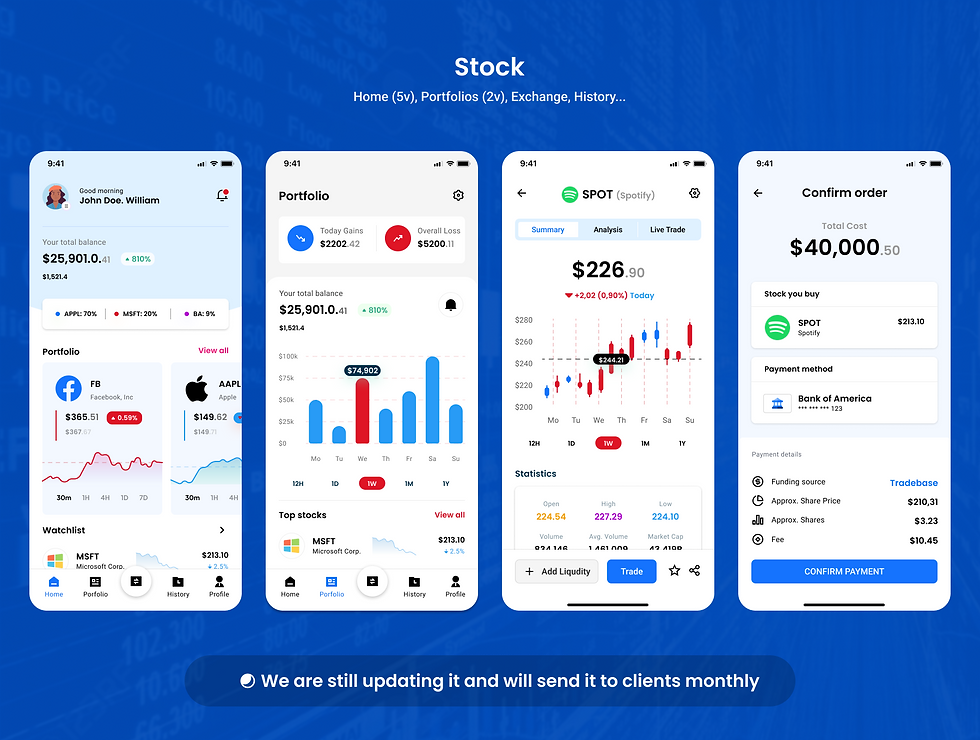

Clone & Recreate: Pick your favorite app or website and replicate its UI. You can also use this source to start designing top landing pages.

Challenge Yourself: Participate in “100 Days of UI” or daily Dribbble prompts.

Leverage AI & Community

Ask ChatGPT or Perplexity for plugin suggestions (“Best Figma plugin for data visualization”).

Share work on Figma Community; remix others’ files to learn best practices.

Use AI-powered critique tools to get instant feedback on color, spacing, or accessibility.

Within weeks, you’ll master the fundamentals — and soon you’ll be shipping interactive prototypes and design systems that drive real product outcomes.

About Building Strategy

Launch & Grow Your Business with Figma

How Awaynear Leverages Figma for Speed & Quality At Awaynear, our Figma-powered design process delivers turnkey digital assets in days, not weeks:

Landing Page in 3 Days — from $189 (regular $289)

Full Website in 7 Days — $599 (regular $799)

Pitch Deck in 5 Days — $389 (regular $549)

Ready to accelerate your launch? Explore our Figma-driven services → awaynear.com Chat live now or schedule your free consultation

Final Take

Figma’s stunning IPO day — capped by a 198 percent first-day rally — was much more than a stock market spectacle.

It marked the arrival of design collaboration as fundamental infrastructure for any modern product team.

For founders, it underscores that world-class design tooling is within reach, no longer gated by hefty subscriptions or steep learning curves.

For investors, Figma’s performance highlights the enormous value of platforms that fuse creativity, community, and cloud-native scale.

Yet the journey has just begun. With $1 billion in break-fee cash, an independent spirit post-Adobe, and a public mandate to innovate, Figma is uniquely positioned to expand beyond its core — into developer tools, no-code web builders, and AI-driven creative assistants.

As the design economy continues to democratize, Figma will remain at its epicenter, powering the next generation of startups, agencies, and enterprise teams.

In a world racing toward ever-more rapid iteration, one truth stands clear: Design is code, and Figma is the compiler.

Whether you’re sketching your first landing page or scaling a global SaaS platform, the IPO of FIG is your invitation to build faster, collaborate smarter, and invest in the future of creative infrastructure.

Thanks for reading.

Figma is now not only the dominant collaborative design software for creating great products, but also a compelling company to consider investing in.

Discover how the below products can transform the way you build, grow, and live.

Build Smarter with Lovable — A Top-Rated AI Website Builder

Recommended by Awaynear and rated 4.7★ on Product Hunt, Lovable lets you launch stunning, functional websites and web-based apps from just a prompt — no code, no stress.

Why Lovable?

AI-Powered Prompt-to-Site Builder — Go from idea to live site in minutes.

All-in-One Toolkit — CRM, forms, e-commerce & automations built in

No Code. No Limits. — Perfect for startups, solopreneurs, and creators

Ride Smarter with UrbanGlide Pro eBike

Go farther, faster, and greener — combining fitness, freedom, sustainability, and rugged mountain performance in one sleek ride.

Powerful Motor & Long Range — Conquer any trail or commute

Eco-Friendly Alternative — Zero emissions, full adventure

All-Terrain Suspension — Smooth ride on any surface

Fast Charging & Durable Battery — Ride up to 60 miles

Built Tough, Priced Right — Premium performance, no premium tag

Use code ERidePro150 to save $150 (Limited-time) + Free Fast (2–5 day) Shipping (US only)

Discover the Power of OKRs — A Game-Changer for Founders & Teams

OKR. Master the Performance Framework that Google Perfected is a 4.7-star rated book that dives into OKRs, Objectives and Key Results, breakthrough performance and innovation framework used by Google, Amazon, and many top S&P 500 companies.

Mastering OKRs (Objectives and Key Results) is a way to understand how to innovate consistently no matter how small or big your organization is — a powerful framework that fuels innovation, drives alignment, and transforms both business strategy and personal productivity.

Clear, Actionable Framework Learn how to set bold Objectives and measurable Key Results with real-world examples.

Proven by Giants Used by Google, Amazon & Intel — OKRs are the backbone of high-performing teams.

Stretch Goals for Growth Unlock the power of stretch goals to push boundaries and inspire innovation.

For Founders & Startups Align your team, track progress, and scale smarter — from day one.

Life-Changing Beyond Work Use OKRs for personal goals, habits, and leadership growth.

Ready to transform how you lead and grow?

Discover & Download the Ebook and start turning vision into results.

Comments